How much does it cost to borrow 80000

Secured loans can be a great way to borrow 80000 90000 using a valuable asset to get the loan you need. This calculates the monthly payment of a 800k mortgage based on the amount.

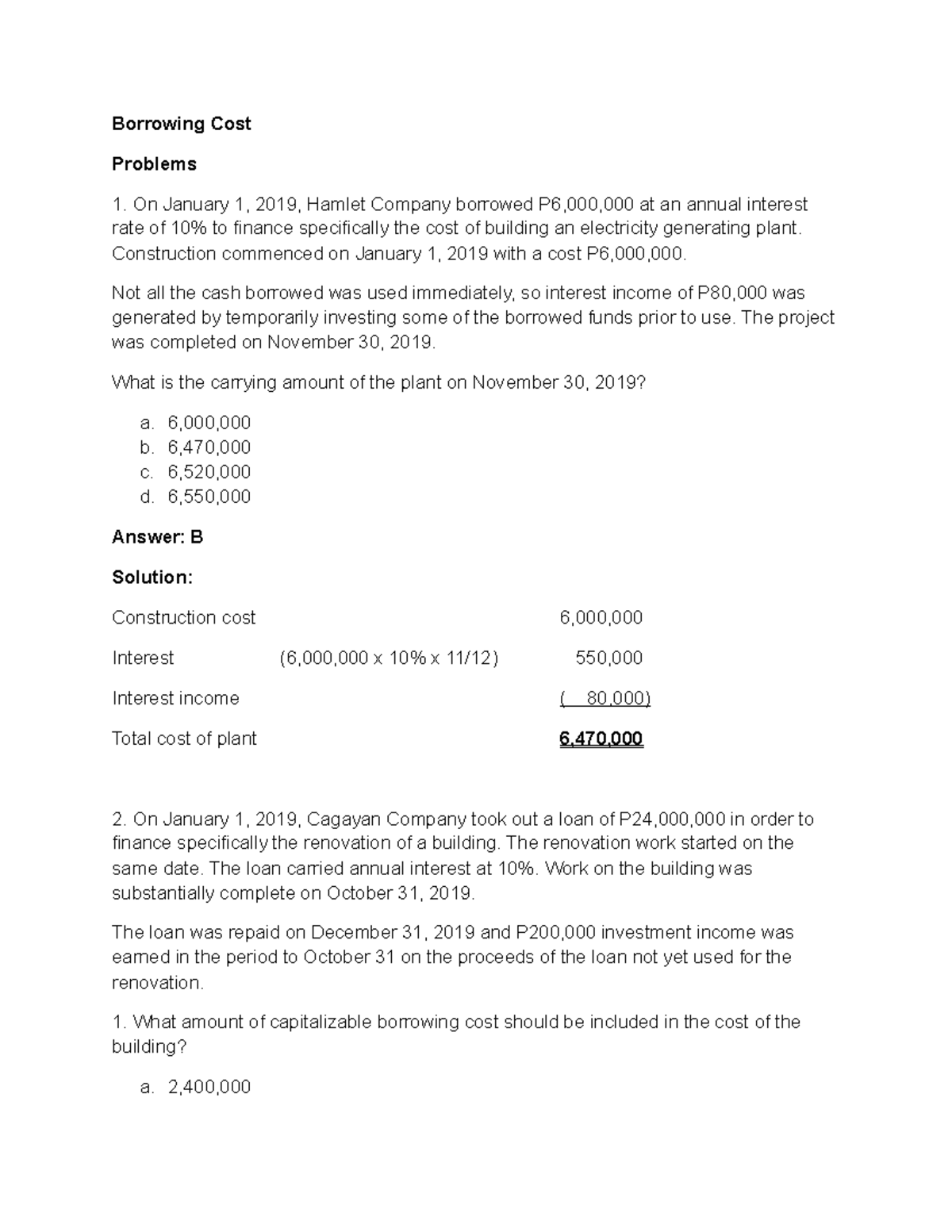

Borrowing Cost Problems Borrowing Cost Problems On January 1 2019 Hamlet Company Borrowed Studocu

What to consider before applying to borrow 80000.

. Use the personal loan calculator to find out your. Assuming you have a 20 down payment 20000 your total mortgage on a 100000 home would be 80000. Just fill in the interest rate and the payment will be calculated automatically.

This calculates the monthly payment of a 80k mortgage based on the amount. Use our loan payment calculator to determine the. Monthly payments on an 800000 mortgage.

Just fill in the interest rate and the payment will be calculated automatically. So it really depends on what you can afford to repay each month. Best Loans of 2022.

At a fixed annual rate of 55 a 50000 loan would take a little over 11 years to repay if your monthly. 80000 Loan at 5 Interest Rate. Payment for a 64000 loan for 30 years at 48.

How much does a 60000 loan cost overall. This asset can be a number of things depending on the lenders. 3 to 25 years.

Private Mortgage Insurance PMI A down payment of less than 20 often requires PMI which will increase your monthly payment. 52 rows How much will my investment of 80000 dollars be worth in the future. Adjustable and flexible you can adjust the amount of money you want to borrow and the period of time you would like to borrow for.

How much does a 60000 loan cost overall. 30 Year 800000 Mortgage Loan. 361 rows Assuming you have a 20 down payment 16000 your total mortgage on a 80000 home would be 64000.

Browse the monthly payments below for a 80k loan based on time and interest rate. For a 80000 home a 20 down. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 381932 a month while a 15.

Our experts compare the market so you dont have to. How to use our 60000 repayment calculator. You will have earned in.

Shawbrook Variable Secured Loan. For a 30-year fixed mortgage with a 35 interest rate you. The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan.

10 Year 80000 Mortgage Loan. At a fixed annual rate of 55 a 50000 loan would take a little over 11 years to repay if your monthly repayment. The UKs largest range of secured loans.

Just a small amount saved every day week or month can add up to a large amount over time. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000. Simply enter in how much you want to.

For a 30-year fixed mortgage with a 35 interest rate you would be. 10337774 overall Check eligibility. Annual Percentage Rate the annual cost of borrowing or lending money.

5 Properties In 5 Years A Complete Roadmap Elevate Realty

Solved 1 The Ledger Of Infirm Sick Co As Of December 31 20x1 Includes Course Hero

Heloc Calculator Calculate Available Home Equity Wowa Ca

Average Mortgage Loan Canada 2021 Statista

/ScreenShot2019-01-15at3.35.40PM-5c3e455dc9e77c0001915edd.png)

Amortization Calculator

Personal Loan Calculator 2022 Calculate Your Monthly Payment Smartasset Com

Average Mortgage Loan Canada 2021 Statista

2021 2022 Income Tax Calculator Canada Wowa Ca

Why Households Need 300 000 To Live A Middle Class Lifestyle

Interest Rate Of Mortgage Loans Mexico 2022 Statista

Overview Of The Cost Of Capital Ppt Download

Understanding Company Accounts Corporate Watch

Solved Additional Information Estimated Net Realizable Value Of The Notes Course Hero

What Are Interest Rates How Does Interest Work Credit Org

How To Pay Off 80 000 In Student Loans Credible

How To Pay Off 80 000 In Student Loans Credible

Apr Calculator Breakout Capital